Exclusive brokerage and organizational performance in market crises

Crises are “sudden, unexpected, and massively disruptive” events.[1] Crises, such as financial meltdowns, terrorist attacks, disease outbreaks, wars, or other episodes in which “society and normal operations are interrupted” [2] raze established opportunities, while also creating new ones. A clear though untested implication of a large body of network theory is that brokers are especially well-suited for the extreme conditions of change, scarcity, and uncertainty that abrupt, “fast-burning” crises bring about.[3] In such conditions, as industry dynamics destroy old priorities, brokers appear positioned both to navigate the resulting uncertainty and to cultivate the best opportunities.[4] Since brokerage positions offer early access to diverse perspectives as well as autonomy in exchange relations,[5] it’s easy to imagine occupants of such positions moving more flexibly than their peers to safe havens when crises erupt. Unlike firms trapped in tightly intertwined networks, brokers appear poised to see their network-based advantages amplified, not weakened, in exigent circumstances.

Together with Nghi Truong, an ESMT Berlin alumna now on the faculty of Sasin School of Management, alongside scholars at INSEAD and City University of Hong Kong, we sought the test the foregoing intuitions. Our guiding question was this: how does crisis affect the link between brokerage and firm performance?

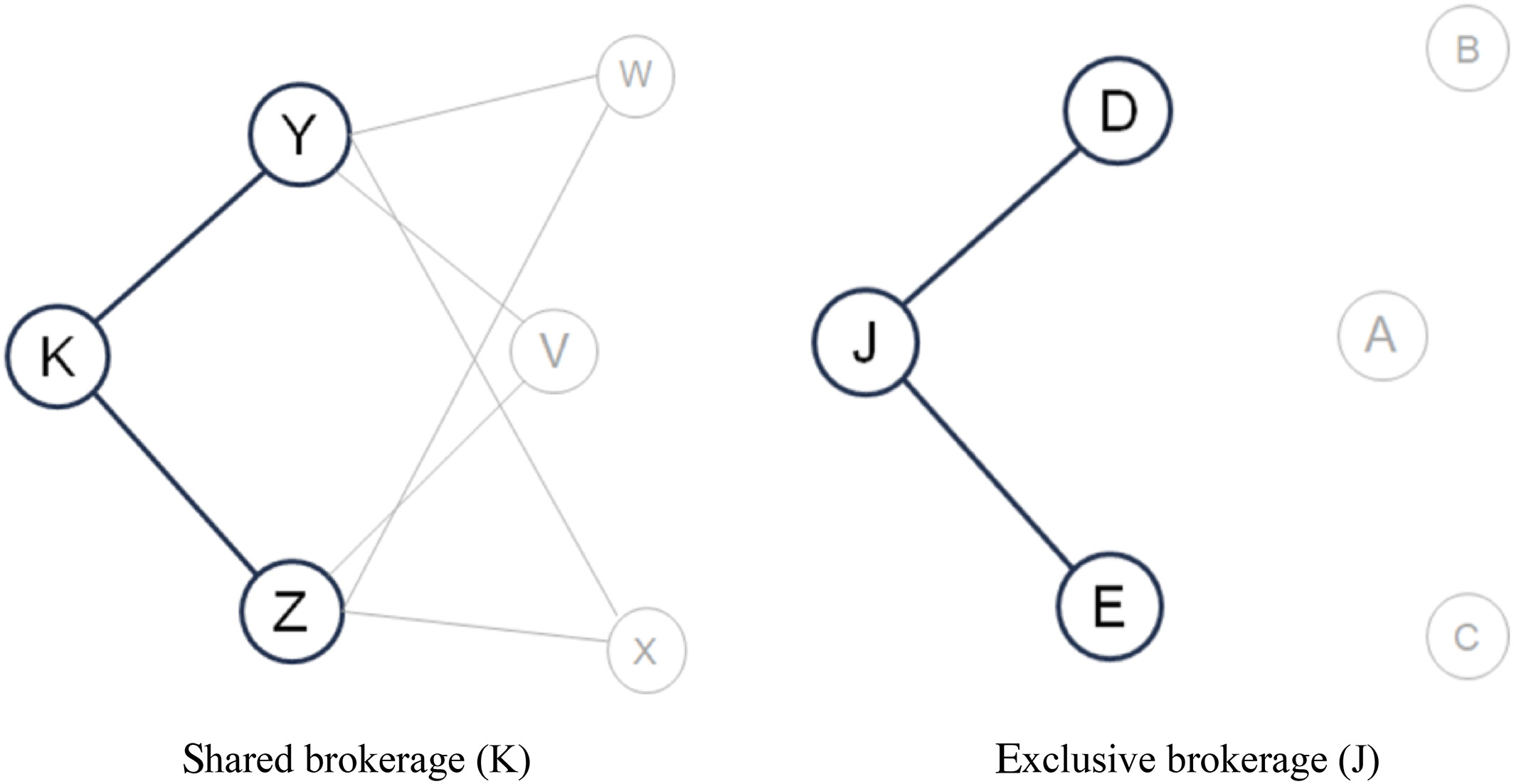

Our team took the bursting of the dot.com bubble as an experiment to study the impact of crisis, examining the consequences for internet-active investment banks after crisis hit. We analyzed data on U.S. equity public offerings from 1985 to 2006, focusing on the equity market, which was significantly impacted. We distinguished between firms acting as uncontested hubs in hub-and-spoke networks (“exclusive brokers”) and firms lacking these differentiated network positions. If you’re an exclusive broker, like J in the network diagram below, you can recombine the best ideas and opportunities from otherwise disconnected collaborators, such as D and E. Importantly, you can do so without having to contend, as K does, with other, “shadow brokers” – A, B, and C – who might also wish to integrate these ideas and opportunities. If you’re an exclusive broker, you’re comparatively free from diffuse competition – not unlike a wolf unencumbered by foxes salivating over the same prey.

Our quasi-experimental analyses yielded findings that both converge with and diverge from a long-standing body of network theory. On the one hand, our finding that the dot.com crash of 2000 amplified the favorable effect of brokerage on future performance agrees with a portrayal of brokers as especially well-suited for the suddenly imposed scarcity and uncertainty of crisis conditions.[6] On the other hand, the result that, in this episode, only exclusive brokerage translated into substantial advantage is aligned primarily with very recent work highlighting the potential benefits of monopolistic access to structural holes.[7] Returning our J vs. K contrast, it’s the open triangles of exclusive brokerage, rather than the diamond-like structures of shared brokerage, that confer advantage in crisis.

The latitude afforded by exclusive brokerage is especially helpful, we found, for navigating to a safe haven amidst crisis. Legg Mason, a global asset management firm (recently acquired by Franklin Templeton), offers a striking example of this successful navigation: Legg Mason’s exclusive brokerage position expanded vividly in the wake of the dot.com crisis, and its year-over-year performance in turn increased by more than 20%.

More generally, our analysis showed that exclusive brokers performed on average more than 7% better than otherwise comparable peers. We attributed this performance advantage to the ability of exclusive brokers to act ambidextrously amidst crisis. Such firms were able to explore new business relationships, while simultaneously exploiting their positions in known sectors. Ambidexterity, to draw on James March’s canonical intuitions, involves “exploring new possibilities,” while also “exploiting old certainties.” Exclusive brokers, our study revealed, are well-positioned to find the new, while leveraging the old and familiar. We also found similar results when examining a second disruption, the housing crisis of 2008.

Our finding that crisis favorably affects the brokerage-performance relationship suggests future research should ask whether exclusive brokerage is valuable for eluding one of the most seductive options facing organizations engulfed in crisis: the tendency to reproduce strategic behaviors that worked well pre-crisis.[8] A subtle danger of market shocks is that those struck by them may be inclined to “dig in their heels” and find self-deluding comfort in strategic inertia, as “they regress to their most habituated ways of responding.”[9] Exclusive—more than shared—brokers may be best positioned to avoid the “myopic blind spots”[10] that can plague network-constrained producers. This privileged, panoramic view has its roots in the extreme diversity of stimuli reaching exclusive brokers. As sole mediators between unconnected partners, they face uniquely low risk that other third-parties homogenize the perspectives they face. New research on crises and path dependence will likely show that exclusive brokerage yields the greatest freedom from strategic myopia.

Our study also carries an important implication for management practice: network-related resources that appear excessive and even seem tangential in normal situations could become crucial for firms' survival in crises. Stated in terms of the behavioral theory of firm, these network-related resources are instances of “slack.”[11] “Exclusive access to contacts in many different groups”[12] can be thought of slack in social capital that requires considerable investment. Maintaining exclusivity, like other investments in slack, often requires monitoring and associated interventions to keep disparate contacts fully apart and thus unlikely to connect via a proximate third party. While preserving these excess resources is expensive in normal, noncrisis-ridden phases, the recent, mounting frequency and intensity of crises suggest that managers may need to prioritize these resources, to ensure they have them on hand when crisis strikes. Uncontested structural holes are therefore not unlike insurance policies that can seem expensive while they’re being maintained, but which prove invaluable when crises erupt.

A broader implication of our findings concern the fact that, in recent years, we’ve witnessed a myriad of crises – the pandemic, various wars and conflicts, as well as market turbulence and inflation. For many firms, these crises are detrimental, but for firms occupying unique brokerage positions, opportunities for ‘generative resilience’ may well abound.

This research was published in the Strategic Management Journal and can be viewed here.

[1] Wenzel, Stanske, & Lieberman, 2020, p. V8.

[2] Hallgren et al., 2018, p. 136.

[3] Boin et al., 2021; 't Hart & Boin, 2001

[4] Madhavan et al., 1998; Podolny, 2001; Burt, 2000.

[5] Burt 2021.

[6]Rowley et al., 2000

[7]Burt, 2015

[8] Weick, 1993; Wenzel, 2015

[9] Weick, 1993, p. 639

[10] Wenzel, 2015, p. 285

[11] Cyert & March, 1963; Wenzel, Stanske, & Lieberman, 2020, p. V11

[12] Burt, 2015, p. 161

This article was drawn directly from research published in the Strategic Management Journal and can be viewed here.