In our ninth episode, Brunno Maradei and Wiebke Merbeth discuss the role of institutional investors in achieving net zero. Institutional investors such as pension funds or insurers invest on behalf of others and thereby command sizeable portfolios. Wiebke is member of the Sustainable Finance Advisory Committee to the German Government and a partner at Deloitte, and Brunno is Global Head of Responsible Investment at Aegon Asset Management. Both point out that the sheer trillions of € that institutional investors manage make them key stakeholders for a transformation agenda involving financial markets. We discuss the toolbox institutional investors have at their disposal, but also that their strategies don't work in isolation. They have to be seen the context of alliances, technological progress on ESG data collection, and of course: regulation.

Listen

Key takeaways

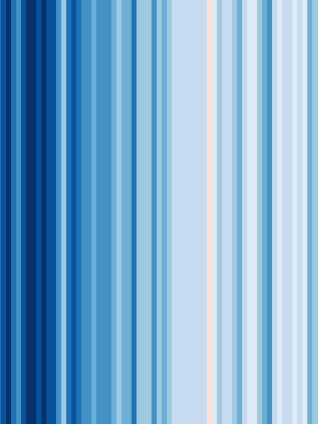

- If you believe that tackling sustainability challenges will require moving capital into the right direction, institutional investors are key stakeholders for the sheer amount of assets they have under management (AUM). The total AUM in Europe amounted to €28.4 trillion by the third quarter of 2022, out of which institutional investors accounted for the biggest share. Germany is by far the biggest market in the EU.

- The toolbox he disposal of institutional investors includes capital allocation (or divestment) decisions, stewardship, active ownership and voting. Stewardship has more impact than divestment from unsustainable industries because if you divest, less ESG-oriented investors will replace you. Legislation, taxation, or the emergence of new technologies have more potential to affect the demand for oil and gas than divestment strategies.

- Regulation also has a key role to play in creating a level playing field between different financial market participants, mobilizing capital towards sustainable economic activities. Institutional investors are important stakeholders to move to net-zero, but the implementation of the Paris Agreement by governments, carbon pricing and regulation to transition the economy are paramount.

Links

- Statista numbers on the asset management industry in Europe and the market share of institutional clients and retail clients within the European asset management industry

- The Institutional Investors Group on Climate Change (IIGCC)

- UN PRI introduction to stewardship

- The Corporate Sustainability Reporting Directive (CSRD)

About Financing Impact

Financing Impact is a podcast about funding and scaling societal impact. This podcast is brought to you by SciFi, the Societal Impact Financing Initiative at ESMT Berlin. SciFi is supported by the Gates Foundation, among others.

For feedback on the show or to suggest guests for future episodes, contact us at scifi@esmt.org

Episodes available on