In our 11th episode, Patrick Nussbaumer and Winnie Odhiambo discuss impact investing in frontier markets. Patrick works for UNIDO’s innovative finance division, and Winnie is an impact investing professional whose career spans working with pension funds, VCs, in private equity and in private debt. We explore the role of development finance institutions (DFIs) in impact investing and how to mitigate country risk in emerging markets. We also discuss the need for more investments into climate adaptation, and the specific challenges of impact measurement in this field.

Listen

Key takeaways

• Perceived and actual country risks play a role in the mobilization of impact investments in emerging economies. There are several approaches to mitigate country risk. These include working with guarantees, investing in highly regulated institutions, and working with local financial institutions.

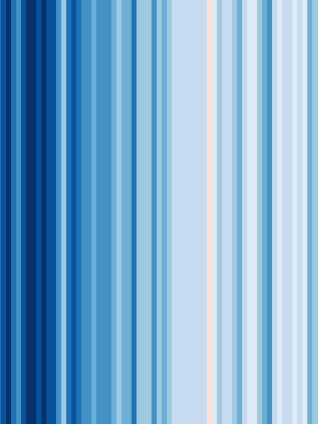

• In climate finance, most funding goes to climate mitigation (preventing or reducing Co2 emissions). However, financing climate adaptation (adjusting to the effects of climate change) also needs significant investments, especially in emerging economies. One challenge in this regard is that we still lack relevant metrics related to climate adaptation that go beyond the number of people reached by a given intervention.

• Winnie expects increased regulatory scrutiny towards impact investors, particularly those who are raising funding from public sources.

Links

- The definition of impact investing by GIIN, the Global Impact Investing Network

- The Catalyst Fund’s report on Investing in Climate Tech Innovation in Africa

- PFAN, the Private Financing Advisory Network, is connecting investors to high-potential climate and clean energy projects in emerging markets

- UNIDO’s Catalyst Fund for Fintech-Enabled Climate Adaptation is accelerating and de-risking innovation in frontier markers

- Development finance institutions (DFIs) active in emerging economies include IFC, the Dutch Entrepreneurial Development Bank (FMO), the African Development Bank and Norfund.

- Patrick’s analysis on Key trends in domestic finance for energy access and transition in frontier markets

- The Benchmark analysis of frameworks for measuring climate resilience and adaptation produced with input from the Working Group in which Patrick is active

- The research on Impact Linked Compensation mentioned by Patrick

About Financing Impact

Financing Impact is a podcast about funding and scaling societal impact. This podcast is brought to you by SciFi, the Societal Impact Financing Initiative at ESMT Berlin. SciFi is supported by the Bill & Melinda Gates Foundation, among others.

For feedback on the show or to suggest guests for future episodes, contact us at scifi@esmt.org

Episodes available on