Patent thickets and the commercialization of new technologies

It was a transaction that made headlines not only in the business press but in news outlets around the world: Google acquired Motorola Mobility for $12.5 billion in a deal closed in May 2012. Less than two years later, Google has sold Motorola Mobility to Lenovo for $2.9 billion. Despite billions of dollars in losses, Google has decided to hold on to up to 20,000 of Motorola’s lucrative mobile patents. This decision confirms what was clear from the outset that this deal was all about patents. Following the sale of Motorola Mobility, the question now arises - why did Google pay almost $500,000 for each of Motorola’s 27,400 patents to begin with?

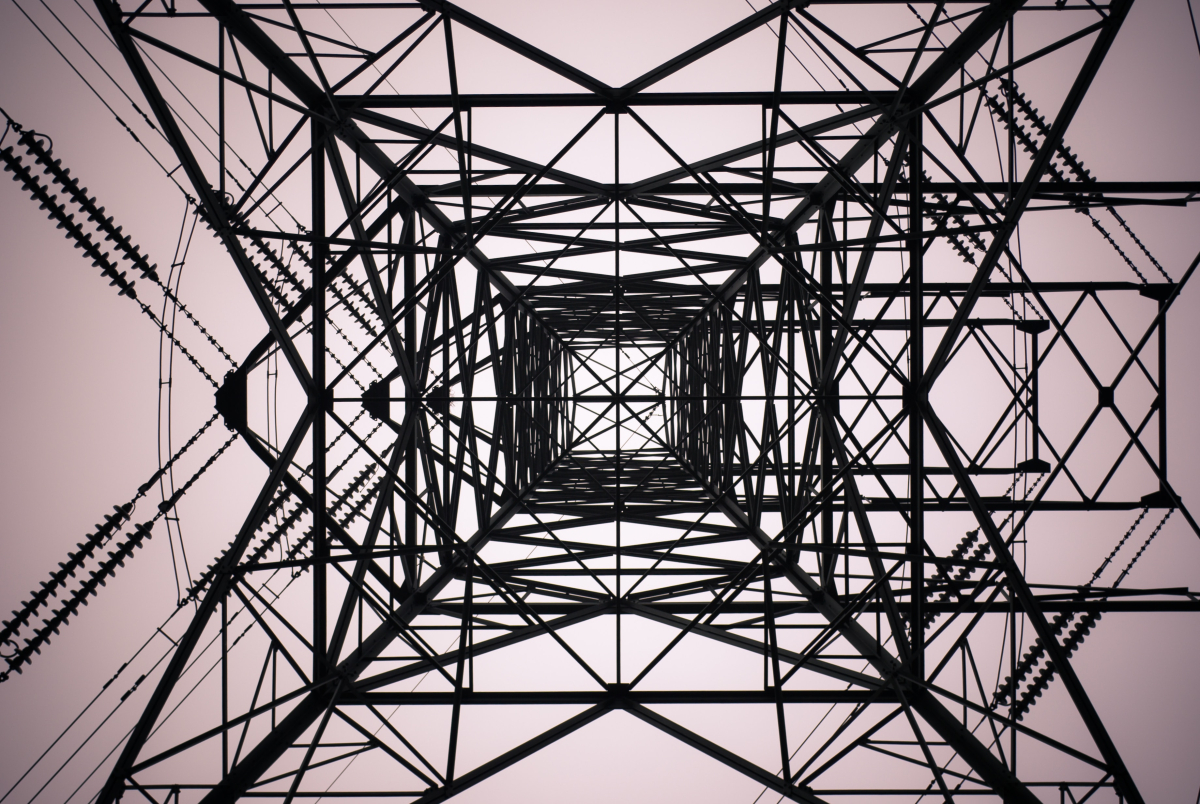

A mobile phone is a combination of a large number of technological components ranging from wireless data transmission standards, LCD screens, to batteries, and antennas. Manufacturers need to get a license from anyone who contributed a component, or at least has patents on a component that is needed to assemble and sell smartphones (this includes not only hardware, but increasingly software that can also be protected by patents). A situation like this, where relevant bits and pieces of technologies – that taken together form an end-product – are owned by various and fragmented patentees, is often called a patent thicket.

In a patent thicket, any patent holder can try to prevent others from manufacturing the product (in Google’s case, a smartphone or the operating system) as a whole by not granting a license or by demanding unreasonably high licensing fees. In this situation, companies resort to granting each other cross-licenses on their entire portfolio of patents. A cross-license gives them the right to use each other’s patents without the threat of being sued. Owning a large patent portfolio becomes a vital bargaining chip in the underlying negotiations, and Google simply did not have enough patents before the Motorola acquisition to be taken seriously in the mobile technology sector.

While this situation in the smartphone industry has been well-reported, it can be assumed that similar problems exist in many other industries that require access to various technologies in order to assemble and sell an end-product. From a research perspective, however, it has not been clear how patent thickets can be detected from publicly available data, and what their effect on firm strategy, market structure, and the pace of innovation is.

In a stream of research spanning several publications and working papers, Stefan Wagner (jointly with his coauthors Dietmar Harhoff and Georg von Graevenitz) developed a methodology that allows to identify the existence and development of patent thickets across industries, and apply it to important managerial and regulatory questions. The proposed identification of patent thickets is based on mutual blocking relationships between firms. Mutual blocking emerges if, for example, firm A owns technology that prevents firm B from pursuing its research without infringing on A’s patents, and vice versa. Patent thickets can then be measured by identifying the network structure of these mutual blocking relations as indicated by references in patent filings (von Graevenitz, Wagner and Harhoff, 2011).

Based on this new measure of patent thickets, Wagner and his coauthors are able to empirically analyze how firms adjust their strategy in the presence of thickets. In a second paper, they show that firms patent more aggressively in the presence of patent thickets, further increasing the problem and inducing a vicious cycle that can explain the recent increase in the number of patents filed in various industries (von Graevenitz, Wagner and Harhoff, 2013).

In their current working paper “Conflict resolution, public goods, and patent thickets” Wagner and his coauthors analyze firms’ use of litigation over intellectual property rights. One key finding is that the existence of patent thickets reduces firms’ incentives to engage in litigation as they have to fear retaliation from the defendant, who is likely to own intellectual property rights that can be used against the plaintiff. It can also be shown that this effect is stronger for firms whose patent rights are threatening many other companies, when compared to companies whose patent rights are relevant to only a few other players in an industry (Harhoff, von Graevenitz and Wagner, 2013).

Taken together, this work has implications both for research as well as in practice. The tendency of patent thickets to self-perpetuate and grow is a worrying trend. Patent thickets lead to an increase in firms’ efforts to patent, while at the same time reducing the incentive to engage in litigation. An implication of this is that patent thickets might constitute barriers to entry for companies without significant patent portfolios. To what extent that ultimately hampers the speed of innovation and the commercialization of new technology is a question open to further research.

Dietmar Harhoff